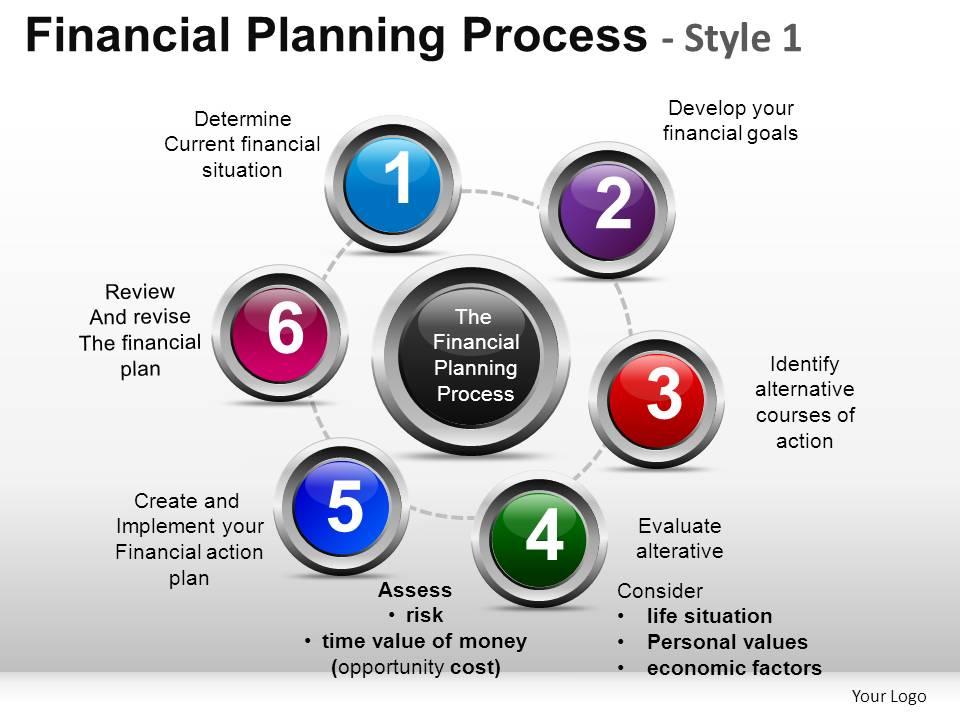

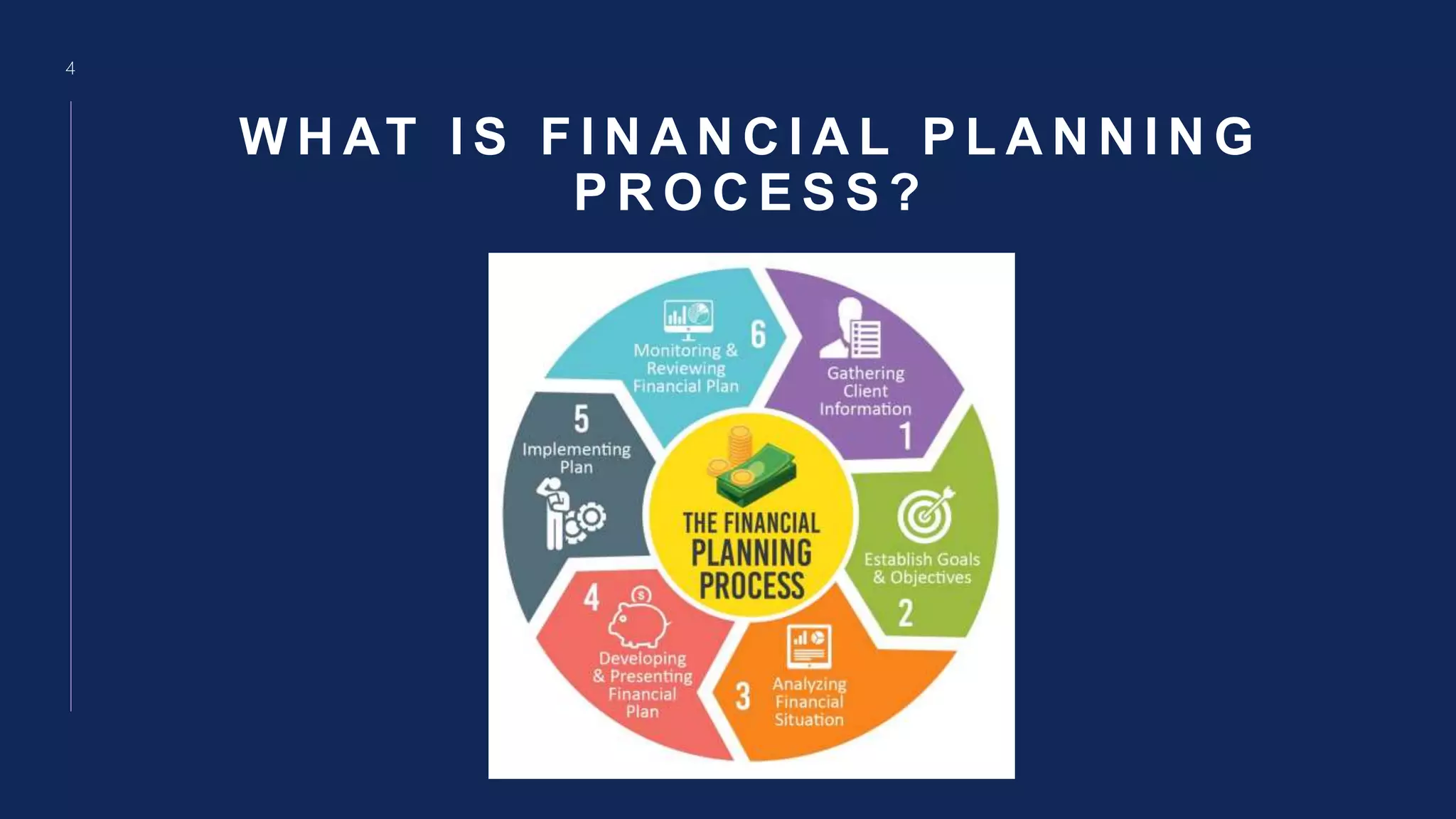

Financial planning isn’t just for the wealthy; it’s a crucial step towards securing your future and achieving your life goals. It’s about understanding your current financial situation, setting realistic goals, and developing a strategy to reach them. Financial planning tools are increasingly available, empowering individuals to take control of their finances and build a more secure and prosperous life. This guide will explore the diverse range of tools available, helping you navigate the landscape and choose the best options for your needs. Whether you’re a seasoned investor or just starting out, understanding how to utilize these resources can make a significant difference. Let’s dive in!

Understanding the Importance of Financial Planning

The benefits of proactive financial planning extend far beyond simply saving money. It’s about creating a roadmap for your financial journey, mitigating risks, and maximizing opportunities. Without a plan, you’re essentially navigating uncharted waters, susceptible to unexpected challenges and potentially missing out on significant rewards. A well-structured plan allows you to:

- Achieve Financial Goals: Whether it’s buying a home, retiring comfortably, funding your children’s education, or simply achieving financial independence, a plan helps you define and prioritize these goals.

- Manage Debt: Understanding your debt obligations and developing a strategy to pay them down is fundamental to financial stability.

- Reduce Risk: By identifying potential risks and developing contingency plans, you can protect your assets and minimize the impact of unforeseen events.

- Increase Savings & Investments: A solid financial plan guides your investment choices, ensuring you’re maximizing returns while managing risk.

- Plan for Retirement: Starting early and consistently planning for retirement is key to securing a comfortable future.

Key Financial Planning Tools – A Comprehensive Overview

There’s a wide variety of financial planning tools available, each with its own strengths and weaknesses. Here’s a breakdown of some of the most popular options:

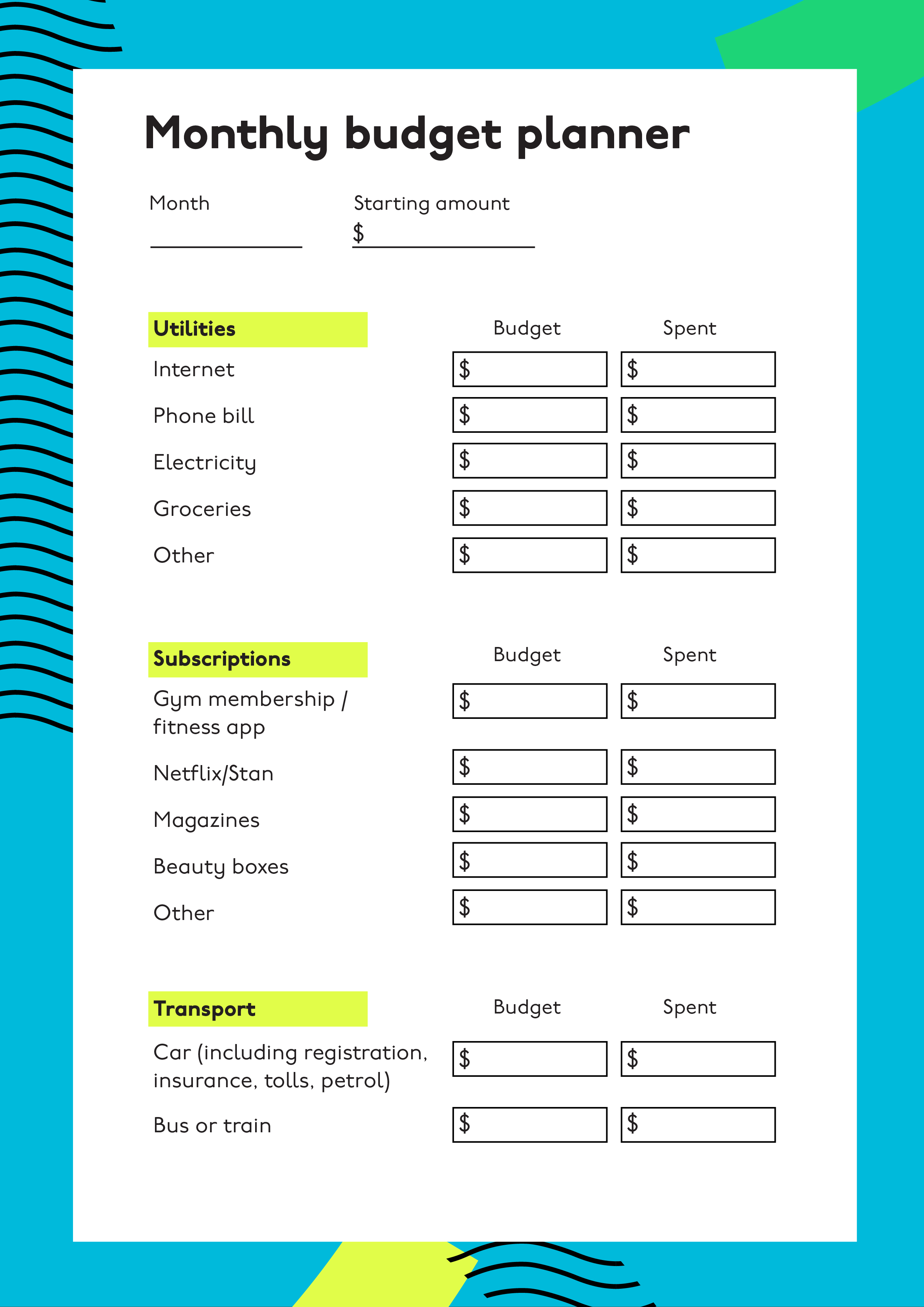

Budgeting Apps

Budgeting apps are arguably the most accessible and popular way to gain control of your finances. These tools automate the process of tracking income and expenses, providing a clear picture of where your money is going. Popular options include Mint, YNAB (You Need a Budget), and PocketGuard. These apps often link directly to your bank accounts and credit cards, automatically categorizing transactions. Financial planning tools often integrate seamlessly with these apps, offering a holistic view of your finances. They can also help you identify areas where you can cut back and save.

Spreadsheet Software (Excel, Google Sheets)

For those who prefer a more hands-on approach, spreadsheet software offers unparalleled flexibility. You can create custom spreadsheets to track your income, expenses, savings, and investments. Financial planning tools often leverage spreadsheet functionality to model different scenarios and assess the potential impact of various financial decisions. This is particularly useful for retirement planning and investment analysis. Learning basic spreadsheet skills is a valuable investment in your financial future.

Online Financial Calculators

Numerous online financial calculators can help you estimate various financial scenarios. These calculators can be used to determine:

- Retirement Savings: Estimate how much you need to save to reach your retirement goals.

- Mortgage Payments: Calculate how much you’ll need to pay each month to comfortably afford a home.

- Investment Returns: Project potential returns based on different investment strategies.

- Loan Payments: Determine the amount you’ll need to pay each month to service a loan.

These calculators are a fantastic resource for understanding the complexities of personal finance and making informed decisions.

Robo-Advisors

Robo-advisors are automated investment platforms that provide personalized investment advice and portfolio management. They typically use algorithms to build and manage investment portfolios based on your risk tolerance, time horizon, and financial goals. Popular robo-advisors include Betterment and Wealthfront. Financial planning tools that incorporate robo-advisors offer a low-cost, hands-off approach to investing. They’re a good option for beginners who want to get started with investing without the complexities of managing their own portfolio.

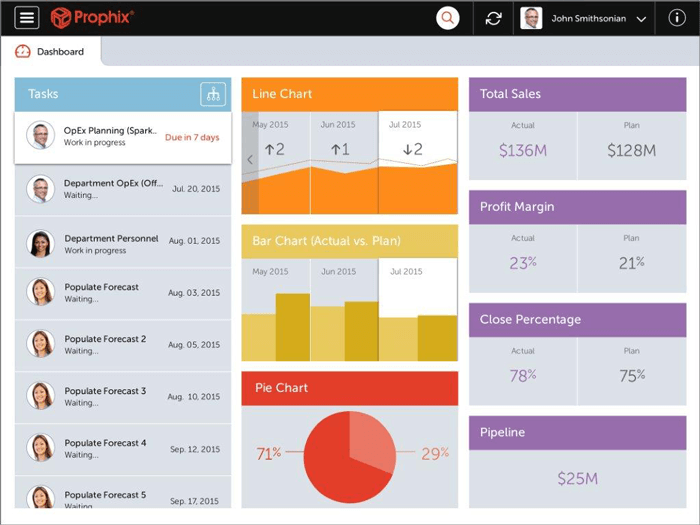

Financial Planning Software (Dedicated Platforms)

Some software platforms are specifically designed for comprehensive financial planning. These tools often combine budgeting, goal setting, investment tracking, and retirement planning features into a single interface. Examples include MoneyGuidePro and Personal Capital. These platforms are often used by financial advisors but can also be valuable for individuals who want a more structured approach to financial planning.

Tax Planning Software

Understanding and optimizing your tax situation is crucial for maximizing your financial well-being. Tax planning software can help you identify deductions, credits, and tax-efficient investment strategies. Popular options include TurboTax and H&R Block. Financial planning tools that integrate tax planning features can significantly reduce your tax liability and improve your overall financial position.

Leveraging Technology for Enhanced Financial Planning

Technology is playing an increasingly important role in financial planning. Mobile apps, online platforms, and sophisticated software are making it easier than ever to track your finances, set goals, and manage your investments. However, it’s important to remember that technology is a tool, not a replacement for sound financial judgment. Always consult with a qualified financial advisor before making significant financial decisions.

The Role of Financial Advisors

While many financial planning tools are available, the most effective approach often involves working with a qualified financial advisor. A financial advisor can provide personalized guidance, help you develop a comprehensive financial plan, and offer ongoing support. They can also help you navigate complex financial products and services. Financial planning tools can be a valuable supplement to, but not a substitute for, professional advice.

Staying Organized and Tracking Progress

Effective financial planning requires consistent effort and organization. Utilize budgeting apps, spreadsheets, and other tools to track your income, expenses, and progress towards your goals. Regularly review your plan and make adjustments as needed. Don't be afraid to seek help from a financial advisor if you need assistance.

Conclusion

Financial planning is an ongoing process, not a one-time event. By utilizing the right tools and maintaining a proactive approach, you can take control of your finances and build a secure and prosperous future. The key is to understand your needs, set realistic goals, and consistently work towards achieving them. Remember that financial planning tools are powerful resources, but they are most effective when used in conjunction with sound financial judgment and the guidance of a qualified professional. Investing in your financial future is an investment in your overall well-being. Start today, and you’ll be well on your way to achieving your financial dreams.