The future of business hinges on the ability to anticipate market trends and make informed decisions. Financial forecasting tools are no longer a luxury; they are a necessity for companies of all sizes seeking a competitive edge. From small startups to multinational corporations, the right tools can provide invaluable insights, allowing for proactive planning and mitigating potential risks. This article will explore the landscape of financial forecasting tools, examining their different types, benefits, and how to choose the best solution for your specific needs. Understanding how to leverage these tools is crucial for anyone involved in strategic financial management.

The rise of sophisticated financial forecasting tools has been driven by several factors – increased data availability, advancements in artificial intelligence, and a growing demand for real-time insights. Traditional methods, relying heavily on historical data and manual analysis, often struggle to capture the complexities of the modern economy. Modern tools, however, utilize machine learning, statistical modeling, and big data analytics to generate more accurate and dynamic predictions. This shift is fundamentally changing how businesses approach financial planning and risk management. The ability to quickly adapt to changing conditions is now paramount, and these tools are providing the means to do just that.

Understanding the Different Types of Financial Forecasting Tools

There’s a diverse range of financial forecasting tools available, each with its own strengths and weaknesses. Choosing the right tool depends heavily on the complexity of your business, the data you have available, and your desired level of detail. Here’s a breakdown of some of the most popular categories:

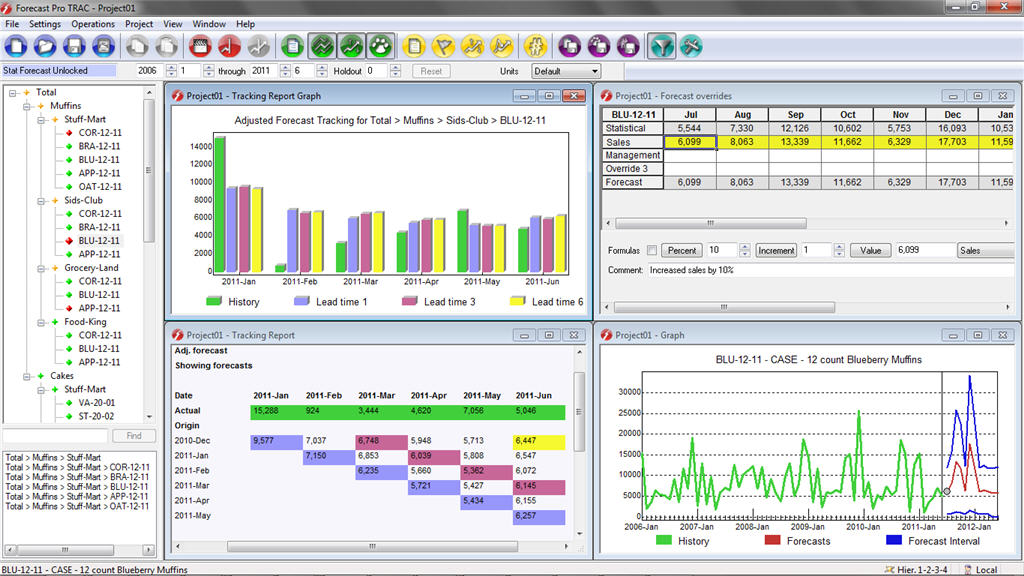

Statistical Forecasting

Statistical forecasting relies on established statistical models – like regression analysis and time series analysis – to project future values based on historical data. These tools are relatively straightforward to implement and often provide a good baseline for understanding trends. However, they can struggle with non-linear relationships and sudden shifts in the market. Example: Using regression to predict sales based on past sales figures, marketing spend, and seasonal factors.

Machine Learning Forecasting

Machine learning algorithms, particularly those based on neural networks and decision trees, are increasingly popular for financial forecasting tools. These models can identify complex patterns and relationships in data that traditional statistical methods might miss. They are particularly effective at handling large datasets and adapting to changing market conditions. Key benefits: Improved accuracy, ability to incorporate external data sources, and the potential for dynamic adjustments.

Scenario Planning Tools

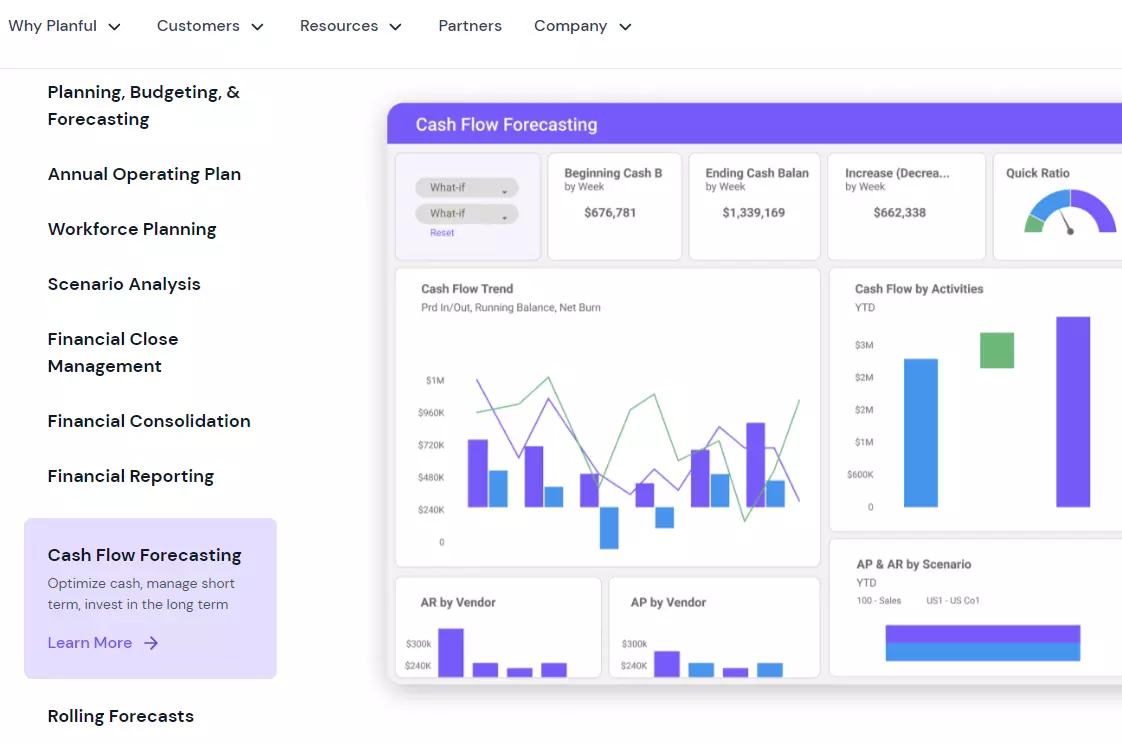

Scenario planning goes beyond simple forecasting and involves developing multiple plausible future scenarios based on different assumptions about key variables. This allows businesses to prepare for a range of potential outcomes and assess the impact of various risks and opportunities. Example: Creating scenarios based on different economic growth rates, interest rate changes, and consumer behavior.

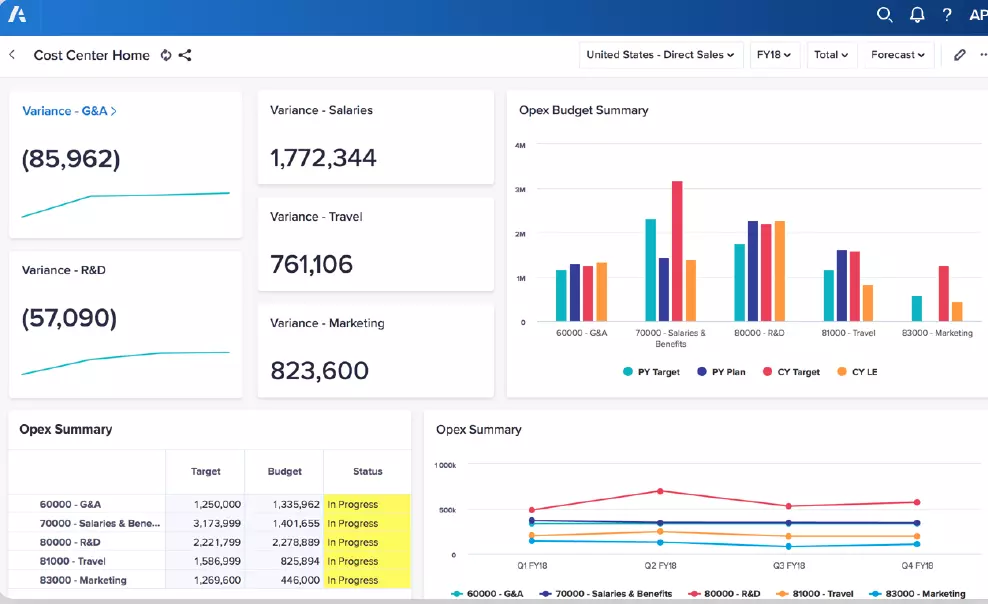

Business Intelligence (BI) Platforms

Many BI platforms now include built-in forecasting capabilities, offering a convenient way to visualize and analyze data. These platforms often integrate with other data sources, such as CRM systems and ERP systems, providing a holistic view of the business. Benefits: Easy to use, collaborative, and often provide interactive dashboards for monitoring performance.

Leveraging Forecasting Tools for Strategic Decision-Making

The real value of financial forecasting tools lies in their ability to inform strategic decision-making. Here are some specific ways businesses can utilize these tools:

Sales Forecasting**

Accurate sales forecasts are critical for managing inventory, staffing, and marketing budgets. Tools can help predict future sales based on historical data, market trends, and promotional campaigns. Considerations: Segmenting sales by product, region, and customer type is crucial for generating reliable forecasts.

Budgeting and Cost Estimation**

Forecasting allows businesses to accurately estimate future costs, enabling them to develop realistic budgets and control expenses. Tools: Software that integrates with accounting systems to automatically generate budget reports.

Risk Management**

By identifying potential risks and vulnerabilities, forecasting tools can help businesses develop mitigation strategies. Example: Predicting potential supply chain disruptions or changes in consumer demand.

Capital Expenditure Planning

Forecasting future capital expenditures – such as investments in new equipment or facilities – is essential for ensuring long-term financial stability. Key Metrics: Return on Investment (ROI) and payback period are critical considerations.

Choosing the Right Financial Forecasting Tool: A Practical Guide

Selecting the appropriate financial forecasting tool depends on your specific needs and budget. Here’s a breakdown of key factors to consider:

- Data Availability: Assess the quality and quantity of data you have available. Some tools require more data than others.

- Complexity of Your Business: Simple forecasting tools may be sufficient for smaller businesses, while more complex models are needed for larger, more dynamic organizations.

- Budget: Forecasting tools range in price from free to thousands of dollars per month.

- Integration Capabilities: Consider whether the tool integrates with your existing systems (e.g., accounting software, CRM).

- Ease of Use: Choose a tool that is intuitive and easy to learn.

Popular Options: A Quick Comparison

- Google Sheets/Excel: Free and readily available, suitable for basic forecasting and simple models.

- Microsoft Excel: A powerful and versatile tool with a wide range of forecasting features.

- Tableau: A data visualization tool that can be used to create interactive dashboards and reports.

- SAS: A comprehensive statistical software package with advanced forecasting capabilities.

- RapidMiner: A no-code machine learning platform that simplifies the process of building and deploying forecasting models.

The Future of Financial Forecasting: Trends and Innovation

The field of financial forecasting tools is constantly evolving. Several key trends are shaping the future of this industry:

- Artificial Intelligence (AI) and Machine Learning: AI and machine learning are becoming increasingly integrated into forecasting models, enabling them to learn from vast amounts of data and adapt to changing conditions.

- Cloud-Based Forecasting: Cloud-based platforms are providing greater scalability, accessibility, and cost-effectiveness.

- Predictive Analytics: Moving beyond simple forecasting to predictive analytics that can identify potential problems before they occur.

- Embedded Forecasting: Integrating forecasting capabilities directly into business processes, rather than relying on separate tools.

As data becomes even more abundant and analytical techniques continue to advance, financial forecasting tools will undoubtedly play an even more critical role in helping businesses make informed decisions and achieve their strategic goals. The ability to anticipate future trends and proactively manage risk will be a key differentiator for companies that succeed in today’s dynamic marketplace.

Conclusion

Financial forecasting tools are no longer a niche technology; they are a fundamental component of successful business management. By understanding the different types of tools available, leveraging their capabilities, and carefully considering your specific needs, you can significantly improve your ability to anticipate future trends and make data-driven decisions. Investing in the right tools and training your team is an investment in the future of your organization. The ability to proactively manage risk and capitalize on opportunities will be the key to sustained success in today’s competitive environment. Ultimately, effective financial forecasting is about empowering businesses to thrive in an uncertain world.