Financial reporting software is no longer a niche requirement; it’s a fundamental necessity for businesses of all sizes. In today’s complex and rapidly evolving business landscape, accurate and timely financial data is crucial for informed decision-making, regulatory compliance, and ultimately, sustainable growth. Choosing the right financial reporting software can be a daunting task, with numerous options available. This article will explore the key features, benefits, and considerations when selecting and implementing financial reporting software to help you streamline your processes and gain a competitive edge. Financial reporting software empowers businesses to manage their finances effectively, providing a clear and consolidated view of their financial performance. It’s about more than just numbers; it’s about understanding the story behind your business’s financial health.

Understanding the Evolution of Financial Reporting

The evolution of financial reporting has been driven by increasing regulatory demands, the rise of cloud computing, and the need for greater efficiency. Historically, businesses relied on manual processes and spreadsheets, often leading to errors and inconsistencies. Today, sophisticated software solutions have revolutionized the way financial data is collected, processed, and analyzed. The shift towards digital platforms has dramatically improved accuracy, reduced costs, and enhanced collaboration. Early systems were often cumbersome and difficult to maintain, hindering a company’s ability to respond quickly to market changes. Modern financial reporting software addresses these challenges head-on, offering a more streamlined and intelligent approach. The move towards automation and data analytics has fundamentally changed how businesses approach financial management.

Key Features of Modern Financial Reporting Software

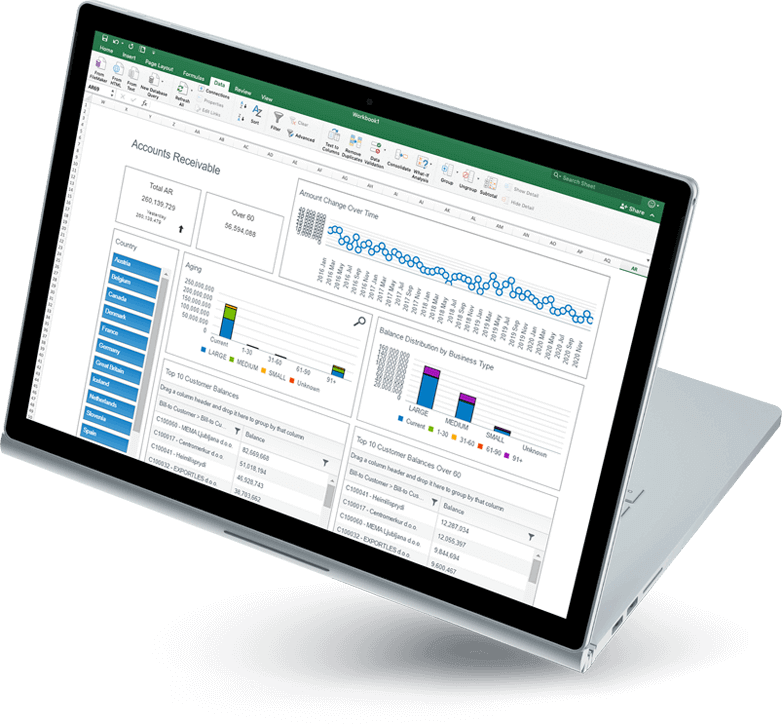

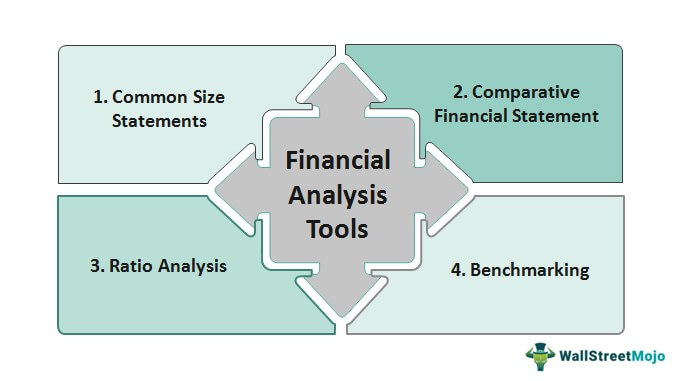

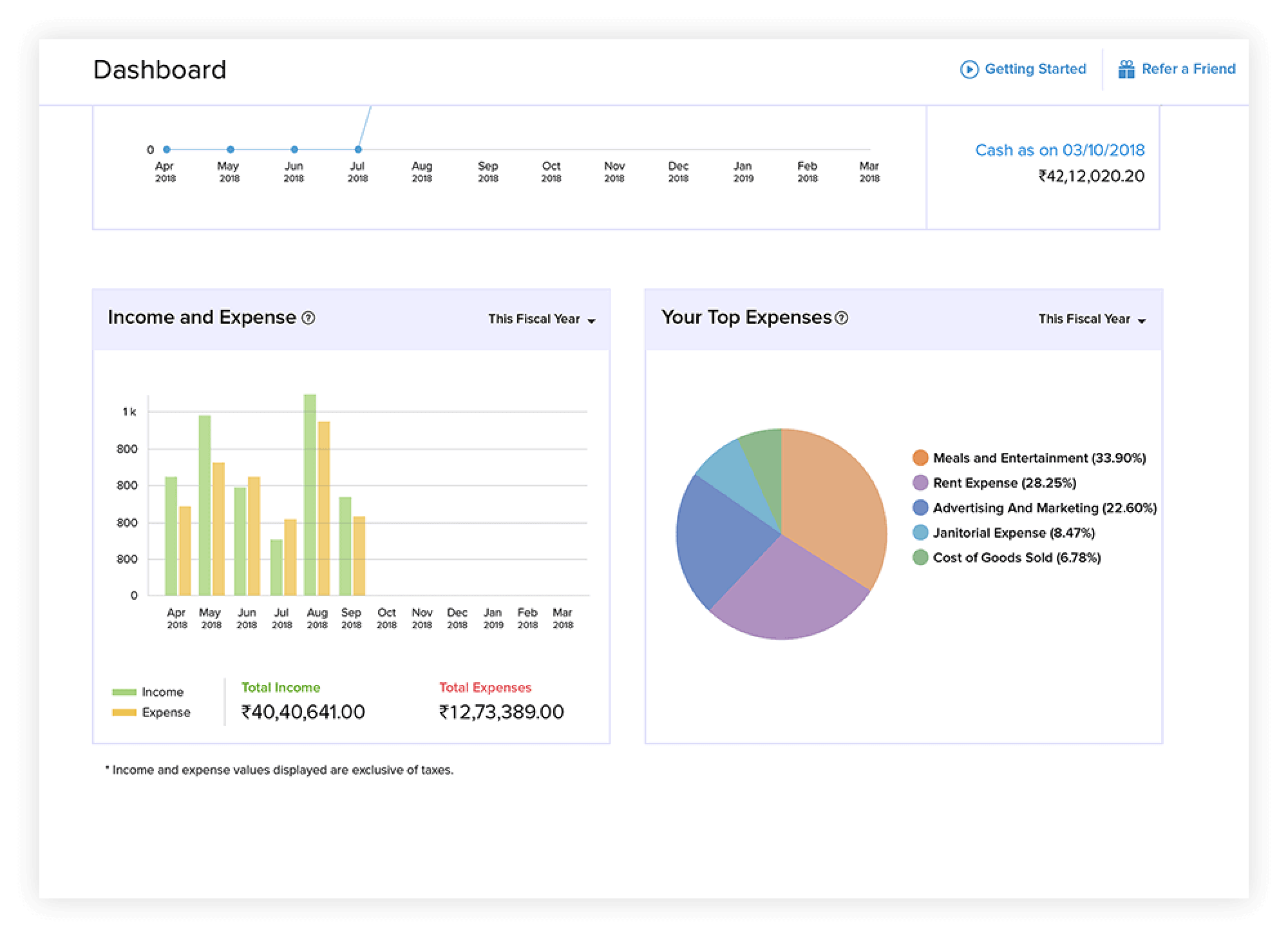

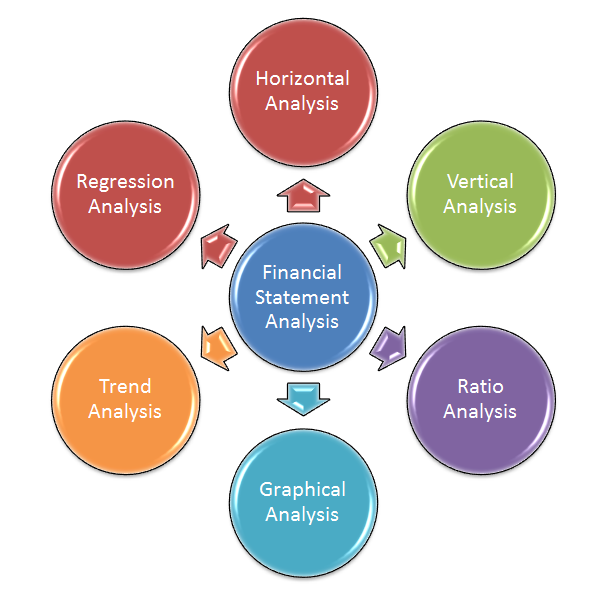

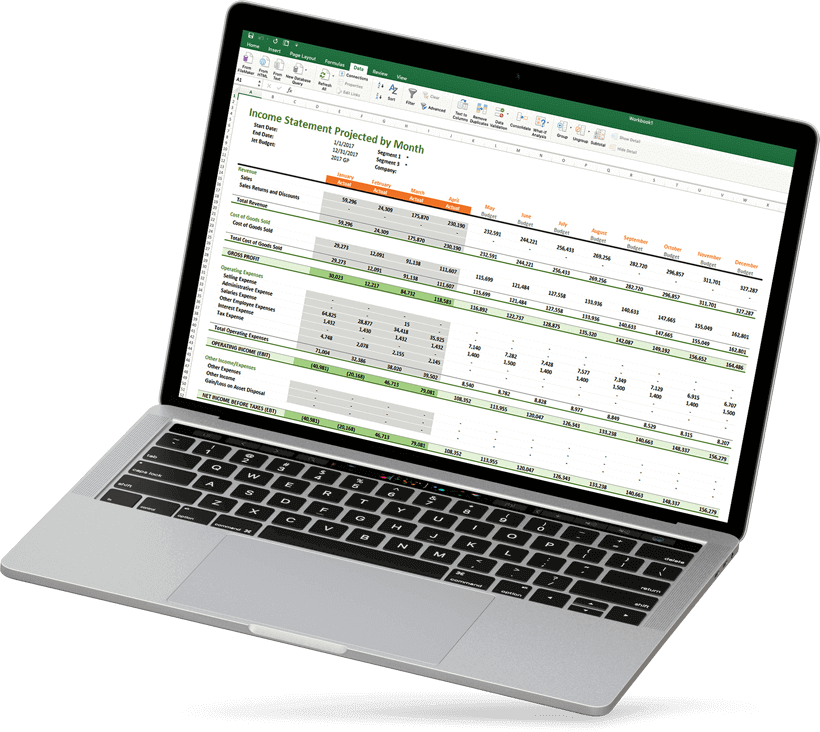

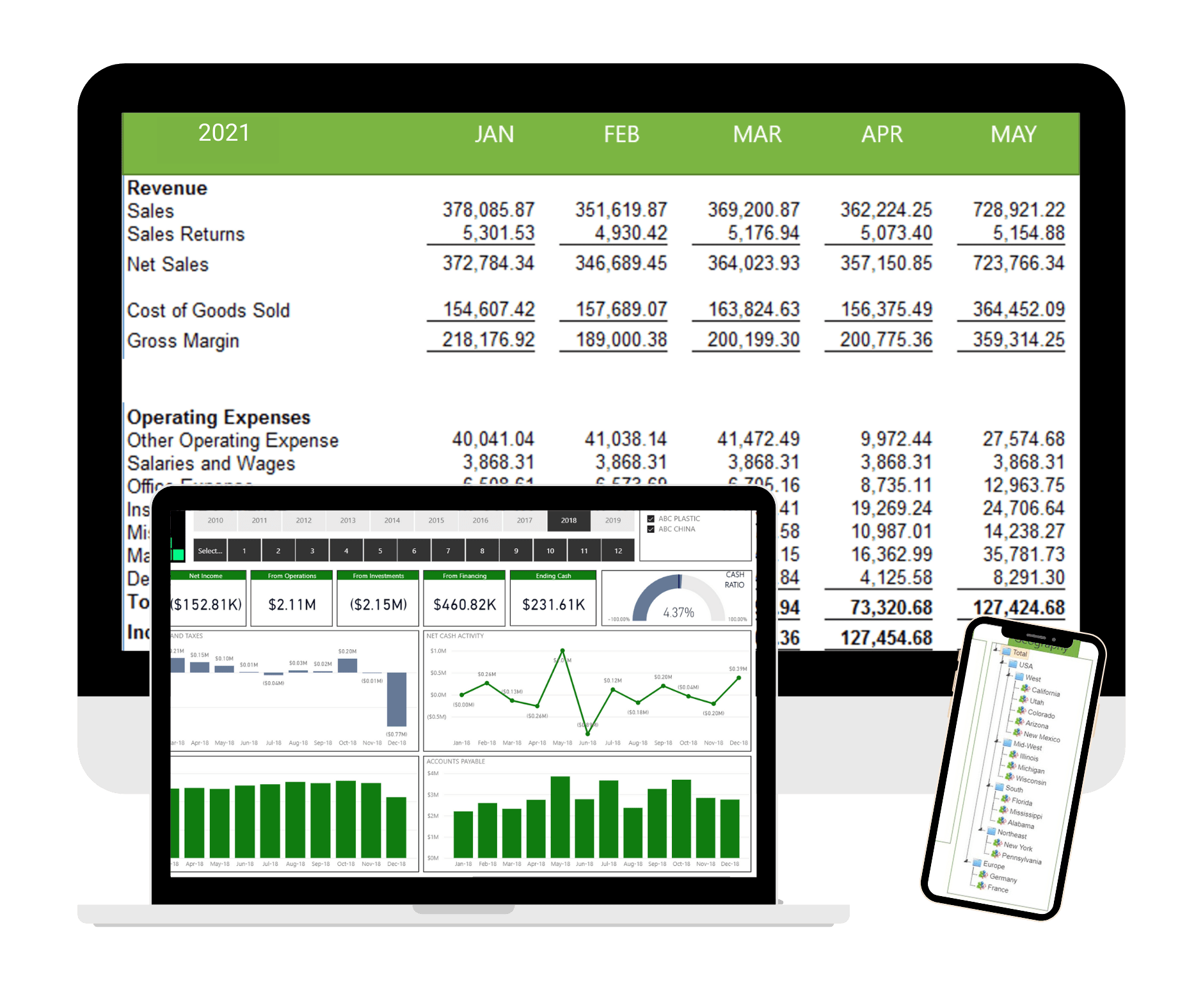

Several key features distinguish modern financial reporting software from its predecessors. These features are designed to automate tasks, improve accuracy, and provide deeper insights into financial performance. Cloud-based solutions are increasingly popular, offering accessibility from anywhere with an internet connection and eliminating the need for expensive on-premise hardware. These platforms often provide robust security features and are easily scalable to accommodate growing business needs. Another crucial feature is real-time data integration. Seamlessly connecting to various data sources – including bank accounts, sales records, and inventory systems – ensures that financial data is always up-to-date and readily available. Furthermore, many platforms offer advanced reporting capabilities, including customizable dashboards, interactive charts, and predictive analytics. Automated reconciliation is a significant benefit, reducing the risk of errors and saving valuable time. Finally, many solutions incorporate features for budgeting and forecasting, allowing businesses to proactively manage their finances and anticipate future challenges.

Benefits of Implementing Financial Reporting Software

The benefits of investing in financial reporting software extend far beyond simply automating tasks. Implementing the right software can yield significant improvements across various areas of a business. Increased efficiency is a primary advantage, reducing manual data entry and streamlining workflows. Reduced errors are often a direct result of automated processes and data validation. Improved accuracy is a critical outcome, minimizing the risk of misreporting and ensuring compliance with regulations. Enhanced decision-making is facilitated by providing clear and concise financial data. Better regulatory compliance is often a key driver, as software can automate reporting requirements and track key metrics for audits. Scalability is a significant benefit, allowing businesses to adapt to changing needs and growth. Finally, improved collaboration among teams – accounting, finance, and operations – is enhanced through centralized data access and streamlined workflows. The return on investment (ROI) from implementing financial reporting software is consistently positive, contributing to a stronger bottom line.

Choosing the Right Financial Reporting Software: A Comparison

Selecting the appropriate financial reporting software requires careful consideration of various factors. There are numerous options available, each with its own strengths and weaknesses. QuickBooks Online is a popular choice for small businesses, offering a user-friendly interface and a wide range of features. Xero is another strong contender, known for its robust accounting capabilities and integration with other business applications. Sage Intacct is a more sophisticated platform, particularly well-suited for larger organizations with complex financial needs. NetSuite is a comprehensive cloud-based solution that offers a wide range of features, including inventory management and CRM integration. Microsoft Dynamics 365 Finance provides a powerful and integrated solution, particularly for businesses already invested in the Microsoft ecosystem. Other specialized platforms cater to specific industries, such as construction or healthcare, offering tailored features and functionalities. It’s crucial to evaluate your specific requirements – such as the number of users, the complexity of your accounting processes, and your budget – before making a decision. Consider factors like scalability, security, and integration capabilities when evaluating different options.

Data Security and Compliance: Protecting Your Financial Information

In today’s digital world, data security is paramount. Financial reporting software must incorporate robust security measures to protect sensitive financial data from unauthorized access and cyber threats. Encryption is a fundamental security feature, protecting data both in transit and at rest. Multi-factor authentication adds an extra layer of security, requiring users to verify their identity through multiple methods. Regular security audits are essential to identify and address vulnerabilities. Compliance with industry regulations such as GDPR and HIPAA is also critical. Many solutions offer built-in compliance features and support for various regulatory frameworks. Data loss prevention (DLP) tools can help prevent sensitive data from leaving the organization’s control. Furthermore, data residency options allow businesses to store data in specific geographic locations to comply with data privacy regulations. Investing in robust security measures is not just a legal requirement; it’s a fundamental aspect of responsible financial reporting.

The Role of Automation in Financial Reporting

Automation is a cornerstone of modern financial reporting software. By automating repetitive tasks such as data entry, reconciliation, and report generation, businesses can significantly reduce errors, improve efficiency, and free up valuable time for more strategic activities. Robotic Process Automation (RPA) can automate complex workflows, mimicking human actions to streamline processes. Workflow automation tools can be integrated with financial reporting software to automate tasks such as invoice processing and payment approvals. AI-powered analytics can analyze large datasets to identify trends and insights, providing a deeper understanding of financial performance. Predictive analytics can forecast future financial outcomes, allowing businesses to proactively manage their resources. The ability to automate these tasks is a key driver of increased efficiency and improved decision-making.

Future Trends in Financial Reporting Software

The financial reporting software landscape is constantly evolving. Several key trends are shaping the future of this industry. Artificial intelligence (AI) is becoming increasingly integrated into financial reporting software, enabling more sophisticated analytics and automated insights. Blockchain technology is being explored for secure and transparent financial data management. The rise of the “no-code” and “low-code” platforms is empowering businesses to build and customize financial reporting solutions without extensive programming expertise. Greater emphasis on cloud-based solutions is expected, driven by the desire for scalability, accessibility, and cost-effectiveness. Mobile-first solutions are gaining traction, allowing users to access financial data and perform tasks from anywhere. Hyper-personalization – tailoring reporting and insights to individual user needs – is becoming increasingly important. Sustainability reporting is gaining prominence, with software solutions designed to facilitate the tracking and reporting of environmental, social, and governance (ESG) metrics. Staying abreast of these trends is crucial for businesses looking to leverage the latest technologies to optimize their financial reporting processes.

Conclusion

Financial reporting software is no longer a luxury; it’s a strategic imperative for businesses of all sizes. By embracing the right tools and implementing best practices, organizations can streamline their financial processes, improve accuracy, enhance decision-making, and ultimately, achieve greater success. The key to success lies in carefully selecting the software that best meets your specific needs, investing in robust security measures, and continuously adapting to the evolving landscape. The future of financial reporting is undoubtedly shaped by innovation, automation, and a growing emphasis on data-driven insights. Ultimately, effective financial reporting software empowers businesses to navigate the complexities of the modern economy and achieve their long-term goals.